rhode island state tax withholding

11-digit number Invoice number. Up to 25 cash back Here are the basic rules on Rhode Island state income tax withholding for employees.

State W 4 Form Detailed Withholding Forms By State Chart

In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three.

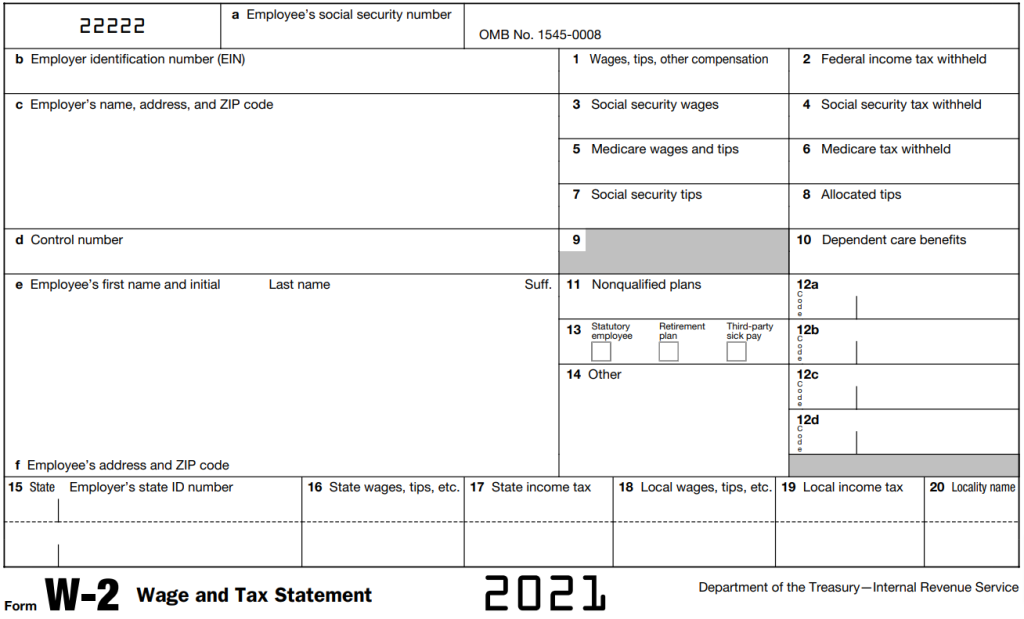

. You must complete Form RI W-4 for your employers. Rhode Island Income Tax Withholding Certificate RI-W4 RI W-4 2022pdf. Rhode Island regulatory law provides that a Rhode Island employer must withhold Rhode Island income tax from the wages of an employee if.

EMPLOYEES FROM WHOSE WAGES RHODE ISLAND TAXES MUST BE WITHHELD. Prior Year 941Q Quarterly Withholding Return - ONLY FOR USE FOR PERIODS ON OR BEFORE 12312019 PDF file less. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children maximum.

Once you have completed Form RI W-4 for your employer Form RI W-4 only needs to be completed if. Ms rush united rosters. The annualized wage threshold where the annual exemption amount is eliminated.

The income tax withholding for the State of Rhode Island includes the following changes. A Rhode Island employer must with-hold Rhode Island income tax from the wages of an employee if. State of Rhode Island Division of Taxation Employees Withholding Allowance Certificate Federal Form W-4 can no longer be used for Rhode Island withholding purposes.

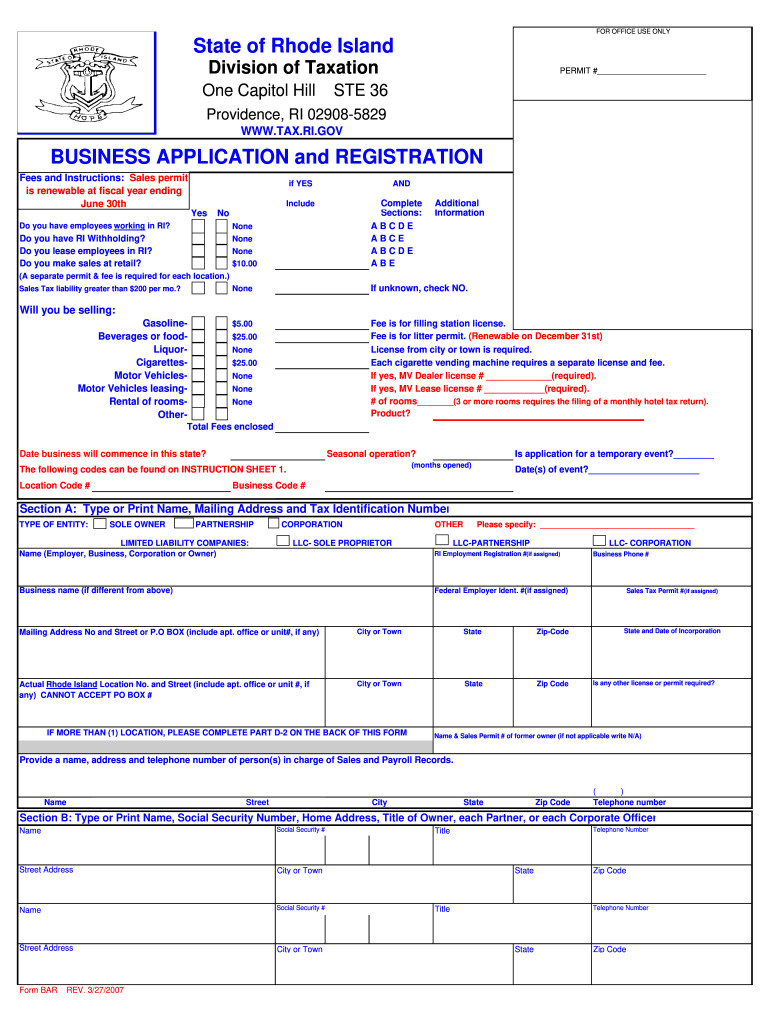

The mailing address for tax returns payments and other correspondence for the Employer Tax unit is now. Thank you for using the Rhode Island online registration service. Bruins half season tickets.

Rhode Island employer means an employer maintaining an office. Subtract the nontaxable biweekly. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three.

Generally Rhode Island withholding is required to be withheld from the wages of an employee by a Rhode Island employer. March 30 2021 Effective. RI Division of Taxation Registration Section 401-574-8829 - withholding and sales tax registration.

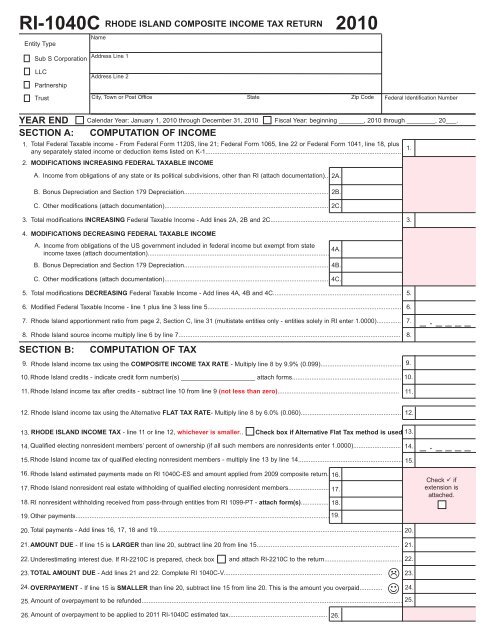

The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022. RI Department of Labor and Training. Pay Period 06 2021.

With rare exceptions if your small business has employees working. BAR Business Application and Registration PDF file less than 1mb. The income tax withholding for the State of Rhode Island includes the following changes.

Detailed Rhode Island state income tax rates and brackets are available. Subtract the nontaxable biweekly Thrift Savings Plan contribution from the gross biweekly wages. The annualized wage threshold where the annual exemption amount is eliminated.

1997 corvette for sale. The income tax withholding for the State of Rhode Island. Martha Martinez a nonresident is selling property in Rhode Island and 20 days before the closing elects the gain method of withholding by computing the RI 713 Election form and.

TAXES 21-18 Rhode Island State Income Tax Withholding. UMass employees who reside in Rhode Island use the RI-W4 form to instruct how RI state taxes should be. Panola county tax assessor.

Rhode Island ID number. Withholding Formula Rhode Island Effective 2021. A the employees wages are subject to Federal.

State Of Rhode Island Rhode Island Division Of Taxation Ri Gov

A Complete Guide To Rhode Island Payroll Taxes

Form Ri 1040c Rhode Island Division Of Taxation

Free Rhode Island Payroll Calculator 2022 Ri Tax Rates Onpay

State Income Tax Withholding Considerations A Better Way To Blog Paymaster

Consumer Alert Rhode Islanders Could Owe State Taxes On Unemployment Wjar

How To Start A Business In Rhode Island

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Ri W4 Fill Online Printable Fillable Blank Pdffiller

Business Application And Registration Rhode Island Tax Ri Fill Out Sign Online Dochub

Rhode Island Paycheck Calculator Tax Year 2022

Rhode Island S Happy And Sad Tax Form Signals Don T Mess With Taxes

State Withholding Form H R Block

State Of Rhode Island Rhode Island Division Of Taxation Ri Gov

Rhode Island State Tax Updates Withum

Rhode Island Income Tax Ri State Tax Calculator Community Tax